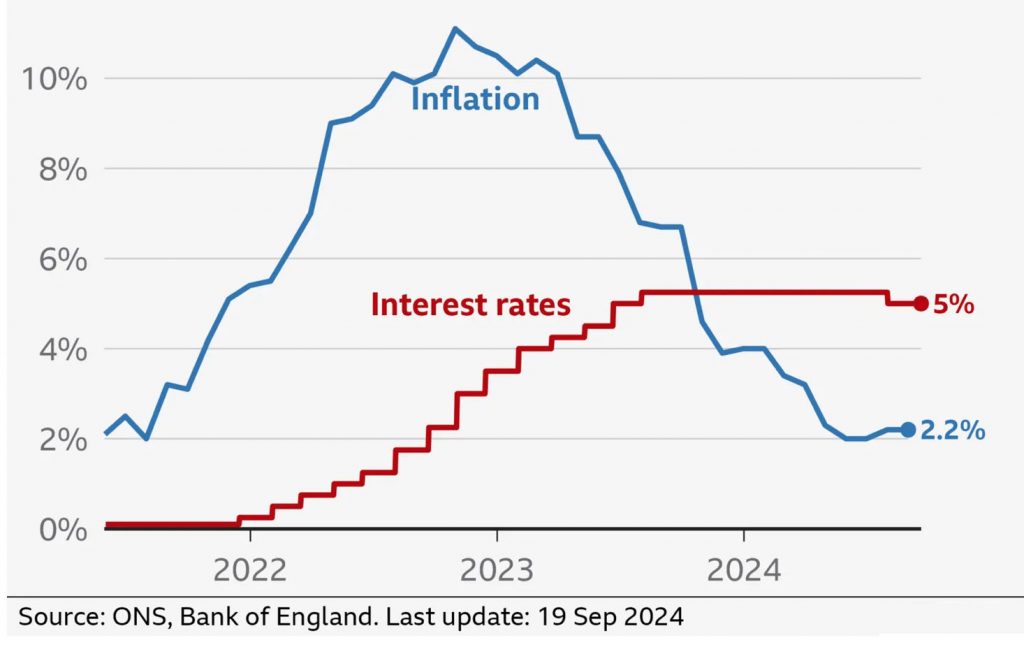

Money News – In an interest rate update this week, Bank of England governor Andrew Bailey has suggested that ‘more aggressive’ rate cuts could be on the horizon if inflation remains in check, which in turn saw announcements from the high street mortgage lenders that they were cutting mortgage rates.

The statement, if it bears fruit in the upcoming November 6th and December 18th Monetary Policy Committee dates could see a much welcomed reprieve to the cost of borrowing for consumers and businesses alike, with the potential of two 0.25% rate cuts, before the end of the year.

The Bank of England kept interest rates on hold at 5% in September, but such a move to lower the rates in November and December, again if this bears fruit, would affect the mortgage, credit card and savings rates for millions of people across the UK and also reduce the costs of borrowing for some 750k UK businesses currently operating with debt.

Lower interest rates would also reduce the cost of borrowing for the government, which combined with increased consumer and business confidence could well see tax receipts rise amid a boost to the economy, to perhaps make the government rethink its approach to filling the “£22bn black hole” it says it inherited from the last government.

Announcing the decision to hold rates in September, Bank of England governor Andrew Bailey said at the time that continued cooling inflationary pressures mean that the Bank should be able to cut interest rates gradually over the upcoming months.

But, he added at the time in September, “it’s vital that inflation stays low, so we need to be careful not to cut too fast or by too much”.

The Bank also considers other measures of inflation when deciding how to change rates, and some of these remain higher than it would like. For example, the services sector – which includes everything from restaurants to hairdressers, was still seeing more significant price rises in recent months which gave the Bank of England pause for thought, in not acting too hastily.

Green Shoots of Optimism

Whilst commercial lending rates are slow to react to Bank of England interest rates and announcements from the Monetary Policy Committee, the UK mortgage lenders are usually the first to react to ‘market signals’ and as such there are green shoots of optimism today with several high street banks all announcing they were cutting mortgage rates. The mortgage lenders Barclays, HSBC, Halifax, Santander & NatWest have all announced they are cutting mortgage rates.

This morning Santander has today launched what it says is “the cheapest mortgage on the UK market”. Moneyfacts, the financial information analysts, subsequently confirmed that the 3.68% five-year deal from Santander, cannot currently be beaten.

Barclays is now offering a fee-free five-year fix with a rate of 3.92% for those with a 40% deposit, while the rate of its Premier two-year fixed deal has dropped to 3.96% and this mortgage product comes with a £899 fee.

At HSBC they announced they had cut the rate of all its two-year and five-year fixed mortgages by up to 0.25 percentage points, with a rate of 3.83% on offer for those remortgaging with at least a 40% equity.

For contrast, mortgage rates peaked in the UK in July 2023, with the average two-year fix reaching 6.86%, while the average five-year fix hit 6.35%.

Adverse Online, the online mortgage broker for adverse mortgages, stated that for customers with bad credit, they could expect rates for bad credit mortgages from 5.99% but that, “typically with the bad credit mortgage market, rates have been 1.0 to 1.5% above the high street but since the inflationary impacts on the base rate, the sources of bad credit mortgage lenders have also been adversely affecting, thus pushing up the rates at which they can access funds.”

Whilst the likes of Barclays, HSBC, Halifax, Santander & NatWest are cutting mortgage rates, they access funding at the lowest possible rates in the UK and as such are hedging their bets that by the time those fixed rate deals end, that their “loss leading’ mortgages will be expiring when more favourable market conditions exist today.

With the economy and consumer confidence floundering any drop in the cost of borrowing will be most welcome to consumer and commercial borrowers alike.

Other Finance & Money News – Pepper Money Specialist Lending Study / Half of people with adverse credit say overall debt up in last year / UK Mortgage Lending to Fall Again in 2024 / Minimum Credit Score to Buy a House in the UK

Business Chamber is an online business and small business news chamber, bringing you selected news on wider economic and business events interspersed with SME news and events that usually dont get a look in by mainstream syndicated news outlets.