As four major lenders announce mortgage hikes many people are worrying where mortgage interest rates are headed, especially in the context of rising cost of living, mortgage arrears and repossessions.

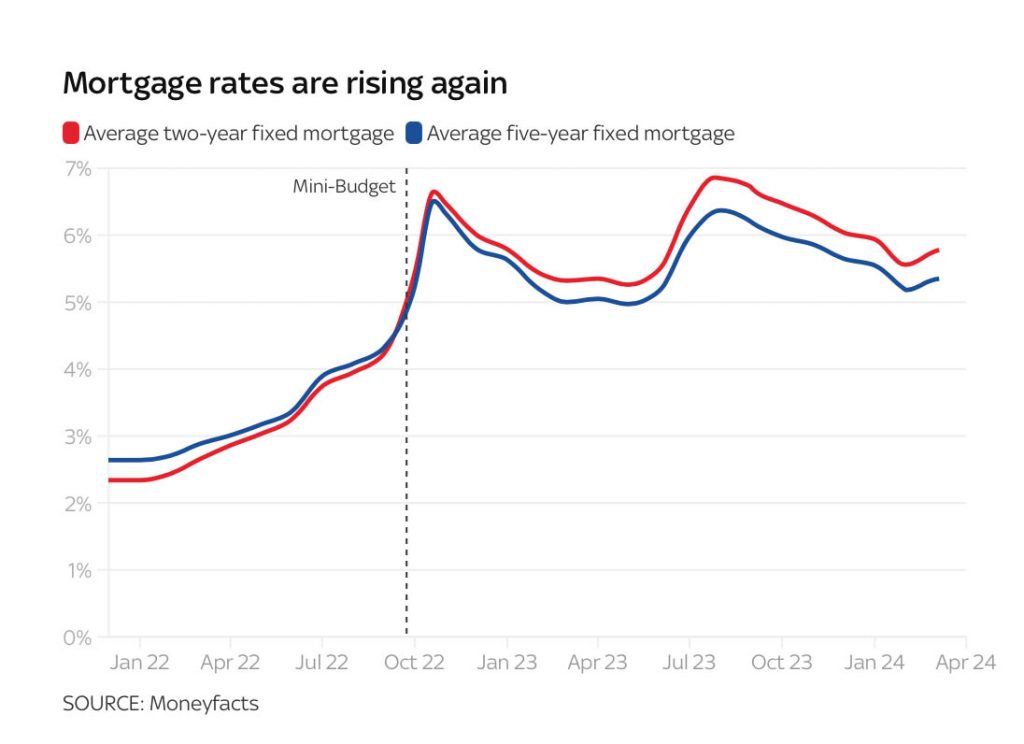

Current average fixed mortgage rates are 5.78% for a two-year (up from 5.56% at the end of January) and 5.35% over five years (up from 5.18% in January), according to Moneyfacts, with rates from 6.34% for adverse credit mortgages.

But, despite several weeks of turbulence on the high street, there has been no change to market forecasts for a first base rate cut as this is still priced in for June – when the expectation is the Bank of England will move its rate from a 16-year high of 5.25% down to 5%.

Two further cuts are then expected before December – which would put the base rate at 4.5% as we head into 2024.

So why have NatWest, Santander, the Co-Operative Bank and as of today Halifax, all increased their rates?

The wave of increases has shocked many brokers, who say that the changes go in the opposite direction to recent movements in the market for interest rate swaps, which are the financial instruments usually used to price mortgages.

Darryl Dhoffer, adviser at The Mortgage Expert, said: “Are we missing something here? Swap rates are reducing yet lenders are increasing mortgage rates. There’s no logic to mortgage pricing right now.”

With the Spring property market looming but already expected to be flat at best, the increase in rates is a bitter blow to borrowers, especially when we are rapidly moving towards the most important time of the year for buying and selling property.

UK Mortgage Lending to Fall Again in 2024

Whilst the rate rises at NatWest, Santander and Halifax were more modest, The Co-Operative Bank saw the biggest jump in rates today, with some products being upped by as much as 1.09 percentage points.

More Pain to Come

The average mortgage rate that UK homeowners are paying is set to rise steadily over the next three years, and peak at 4.2% in 2027, according to an official prediction last week.

By the end of 2027, the last of those on lower 5 year fixed rate mortgages will have caught up to the unprecedented rate rises we saw after the October 2022 Mini Budget.

The Office for Budget Responsibility (OBR), the Treasury’s tax and spending watchdog, says this is significantly higher than the 2% figure just over two years ago.

Business Chamber is an online business and small business news chamber, bringing you selected news on wider economic and business events interspersed with SME news and events that usually dont get a look in by mainstream syndicated news outlets.