GREATER LONDON – Premier Foods financials have continued to see year on year growth with the St Albans company reporting improved revenues and that its trading profit is ahead of expectations when compared to the previous year.

The company, which owns brands from Ambrosia, Batchelors, Bisto, Mr Kipling, OXO and Paxo, plus the Homepride, Sharwood’s and Loyd Grossman cooking sauce brands saw its revenues increase from £975.6m to £1.12bn in the year ended 30 March 2024.

Alex Whitehouse, chief executive of Premier, said: “This has been another really strong year for the business with considerable progress across all our key financial metrics and five pillar growth strategy.

“In the UK, branded revenue increased by 13.6 per cent, accompanied by 29 basis points of market share gain, as we continued to outperform the market.

“Our brands continue to demonstrate their relevance to consumers, helping them cook and prepare nutritious and affordable meals during what has been a challenging time for many people

“We have a strong set of plans for this year, across each of our strategic pillars and with our return to volume growth, we are on track to deliver on full year expectations.”

In addition to an increased return on marketing spend to boost the revenues and profits, Premier Foods also took the decision to cut prices of some of its well known branded products. A move which will no doubt will have helped the business acquire more market share when shrinkflation and price rises in the sector have been rife, during the cost of living crisis.

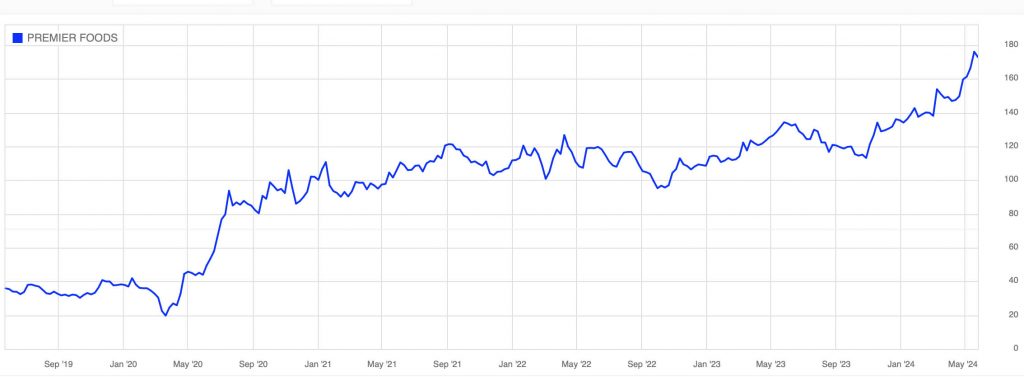

Premier Food Financials Continue to Soar

The performance of Premier Food financials over the past 5 years speaks for itself, especially when looking at the share price growth. When you consider that Unilever’s share price has fallen near 20% over the same period, Arla Foods a near 10% drop and Nestle some 5%, Premier Foods financials seem robust. But when you factor in the likes of Nestle which saw its pandemic share price saw to a CHF128 high in January 2021, to plummet somewhat down to CHF94.98 as at today, with a near 26% drop, then Premier Foods performance is all the more impressive, given its decision to cut retail prices when many others were increasing them.

Whilst there are many underlying factors in a companies share price, Premier Food financials does seem to be attractive for investors, in being able to improve its financials, improve its share price, and improve its market share, all amid a trading environment with threats to global logistics, threats to food and food ingredients security, high inflation and a cost of living crisis.

Perhaps the time has come where the fondness for some of our best loved and well known food brands is waning as prices and shrinkflation see consumers losing out considerably.

SIMILAR LONDON BUSINESS NEWS – Premier Foods financials continues year on year growth / Heathrow Airport reports record winter / London still losing pubs and restaurants post-pandemic / Travelodge 85th London hotel Underway / London’s tourist economy roaring back to life

Business Chamber is an online business and small business news chamber, bringing you selected news on wider economic and business events interspersed with SME news and events that usually dont get a look in by mainstream syndicated news outlets.