UK Finance has today published its housing and mortgage market forecasts for 2024 and 2025 together with projections for 2023 full year numbers.

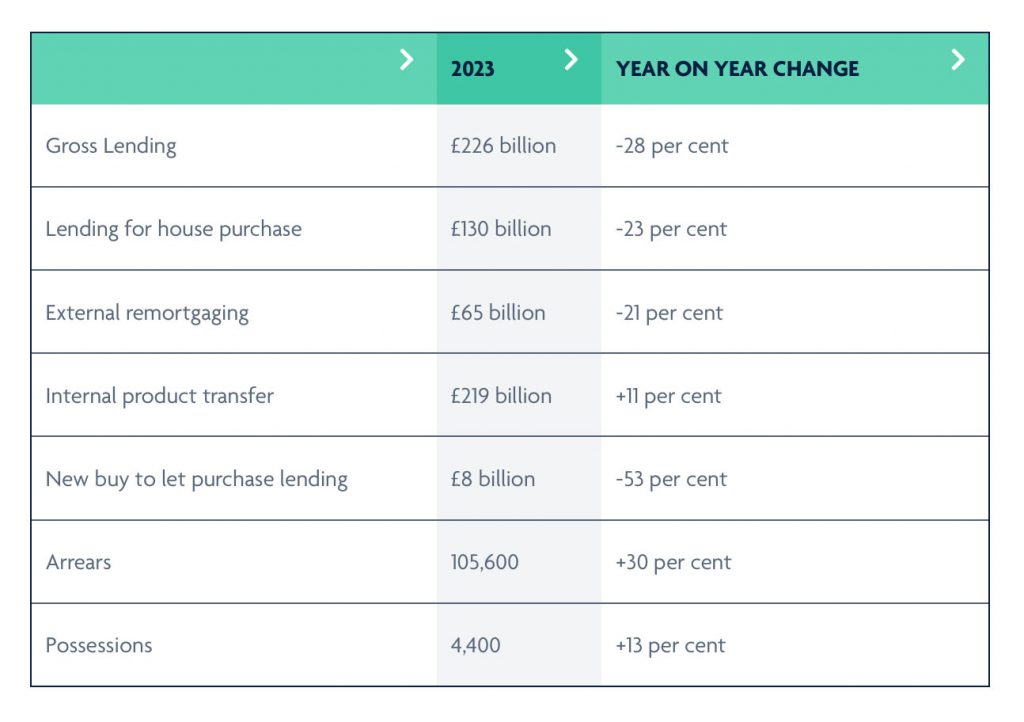

Key figures for 2023:

In 2023 higher interest rates and household costs limited access to mortgage credit. Affordability constraints have also dampened external remortgaging activity, although there was growth in the internal product transfer market, where affordability tests are not required. Cost of living and interest rate pressures also pushed more customers into arrears, which were up on the historically low number in 2022, although the total represents only around one per cent of total outstanding mortgages in the UK.

2024 forecast figures

The outlook for 2024 is one of continuing challenges in the mortgage market; however, the main pressures on affordability look to be peaking now. Whilst it will take some time for the pressure on household finances to recede, we expect things to begin to look up in 2025. Meanwhile, prudent lending standards and extensive lender forbearance will minimise the number of customers who struggle with their mortgage payments through this period.

UK Finance are forecasting the following for 2024:

- Gross lending to fall by a further five per cent to £215 billion

- Lending for house purchase to fall by a further eight per cent to £120 billion.

- External remortgaging activity to fall by a further eight per cent to £60 billion.

- Internal product transfers to fall by eight per cent to £202 billion

- Buy to let purchase lending to fall by a further 13 per cent to £7 billion

- Arrears to increase to 128,800 cases by the end of 2024.

- Possessions to increase by 16 per cent to 5,100 – this would still see possessions lower than in any year from 2019 all the way back to 1981, when the mortgage market was a little over half its current size.

James Tatch, Head of Analytics at UK Finance, said:

“2023 was a challenging year for both prospective and existing mortgage borrowers, facing affordability pressures from higher interest rates and the increased cost-of-living, as well as house prices still at elevated levels relative to income. In the face of these challenges, borrowing for house purchase has been constrained. At the same time most existing customers looking to refinance their loans chose to take a Product Transfer with their current lender, where affordability tests are not required.

With these pressures unlikely to ease significantly in the short term, we expect lending to remain weak in 2024, with a gradual improvement in affordability reflected in a modest increase in activity levels in 2025.

The challenging environment has also pushed more households into mortgage arrears. However, the rigorous affordability tests in place since 2014 are now working to ensure that the vast majority of customers can still afford their mortgage payments even with the increased pressure on their finances. Although we forecast more customers will encounter arrears next year, we expect numbers to peak well below levels seen previously.

As always, any customers who do find themselves in difficulty should speak to their lender at an early stage, as the industry continues to provide help to anyone struggling with a range of tailored support options.”

Arrears increase but set to peak well below previous cycles

In line with our previous forecasts the pressure on household finances, which had built through 2022, began to feed through into an increase in mortgage arrears by the end of that year. This continued through 2023 and, by the end of the year, reached an estimated 105,600 cases with arrears of over 2.5 per cent of the outstanding mortgage balance – an increase of 30 per cent compared with December 2022. Next year, although no significant increase in Bank Rate is expected, the existing pressure on payments will persist, and we forecast arrears will rise to 128,800 by the end of 2024. In 2025, we predict arrears will rise more modestly to 137,800 cases, as the pressure on mortgage payments begins to recede.

source: https://www.ukfinance.org.uk/news-and-insight/press-release/mortgage-lending-fall-in-2024

UK Finance is the collective voice for the banking and finance industry. Representing more than 300 firms across the industry, we act to enhance competitiveness, support customers and facilitate innovation.

Business Chamber is an online business and small business news chamber, bringing you selected news on wider economic and business events interspersed with SME news and events that usually dont get a look in by mainstream syndicated news outlets.